23/12 Jules' Trading Plan

Another big bash on the indexes after economics data came in better than expected (which imply that the FED will not pivot anytime soon…)

State of the Majors Index:

Nasdaq:

Next level to watch on the upside: 10550 then 10700

Next level to watch on downside: 10350/10400

SP500: We managed to step just above the 50MA on the SPX!!!

Next level to watch on the upside: 3900 then 50MA

Next level to watch on the downside: 3780

Market Breadth

My take: Major reversal again, continuing our downtrend. Clearly unfavorable for trading the long side (just look how many stocks doing their 1month low compared to the one doing their 1month high…). Odds are clearly not in our favor, I will take a break until mid next week and re-assess. As for now, not trading is clearly the winning strat for me.

Economics Calendar and Earnings:

=> PCE numbers today, important day.

Sectors:

=> Last day: Chinese stocks, biotech (this is to be noticed) and Gold for the up side. BIG hit on the semis.

=> As for last week: Chinese, silver, gold and Biotech are leading.

Current Exposure:

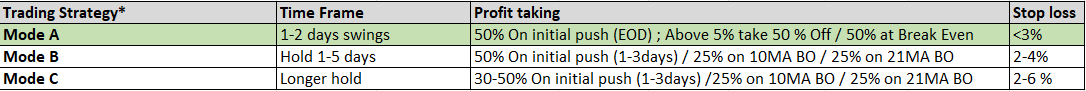

Current Trade Mode:

=> Not much change here although some 2-3 days holdings might be viable.

Emotion State:

=> A

Current Position:

Watchlist and Potential play for the day:

I might take 1-2 trades max for a day trade